Glossy 50: Fashion’s Leaders – Glossy

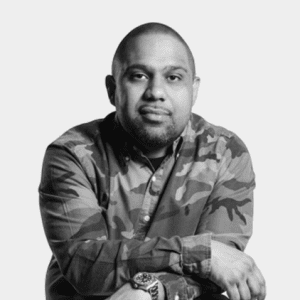

Sr. director, Project Greenhouse (Foot Locker)

Mel Peralta

With more retailers competing for sneaker shoppers, Foot Locker upped its game in September with the launch of an in-house incubator, Project Greenhouse. The project is aimed at connecting with youth culture through exclusive product releases designed by creatives across industries.

“Our goal is to provide a platform that shines a light on what’s next: new innovators, new designers, new product categories, new business ideas,” said Project Greenhouse’s senior director, Mel Peralta. “Rather than just exciting the folks that come through the doors of Foot Locker, Inc. stores, it’s about providing moments that feel special to the industry at large.”

Peralta was recruited from his brand consultancy to head up the incubator. He agreed to sign on when Foot Locker agreed to let him change 80% of the original plan. He now leads a team of two, including product director Fabiano Amorim, former head buyer of popular sneaker boutique Bodega, and marketing manager Victoria Chiang. He said the new incubator concept drew the talent to the 45-year-old company.

“There wasn’t a home for us and our skill sets at Foot Locker prior to Greenhouse being an entity,” he said. “And something like Greenhouse wouldn’t work without having the support of the biggest sneaker retailer in the world.”

Since its launch, Greenhouse’s drops have included product collaborations with designer Nicole McLaughlin, photographer Christina Paik, and Atmos, Adidas and 88rising, the latter of which was released at ComplexCon. All other launches have taken place exclusively on the Greenhouse app.

According to Peralta, Greenhouse’s collections have sold out in anywhere from 13 minutes to three days. One sells at a time, for a total of three to four drops a month.

“When choosing a collaborator, we’re looking at four things,” said Peralta. “Can we learn something from them? Are they currently exciting a customer demographic? What does their design eye look like? And: Can we use our platform to help them leverage their capabilities and broaden the scope of their goals?”

Moving forward, Peralta’s goals for Greenhouse include consistently creating compelling product that consumers can’t find anywhere else and earning customer mindshare in the buzzy sneaker market.

“Today, you have to work harder to be able to gain [consumer] allegiance and trust,” he said. “But that’s what we’ll do, with compelling product, because that’s our job.” –Jill Manoff

Founder and CEO, Untuckit

Chris Riccobono

Chris Riccobono, founder and CEO of menswear brand Untuckit, knew he wanted to start a company long before he came up with the simple idea that drives his brand: shirts designed to be worn untucked.

As someone with little knowledge or interest in fashion beforehand, he was looking to create a brand for people who didn’t want to think too hard about the clothes they wear. Untuckit, founded in 2010, was the result.

Nine years later, the brand has become an unlikely success story, expecting more $200 million in sales this year.

“I really had no idea what the process was for designing clothes or starting a fashion brand,” said Riccobono. “I had zero experience. I was just finding fabric and buttons I liked and wandering into manufacturers in the Garment District. It took a long time to get it right; when you’re new and starting out, it’s really hard to get any attention.”

In the past year, Riccobono has been focusing on translating Untuckit’s local buzz into international expansion. The brand has 80 stores across the U.S. and Canada, and it recently opened two more in the U.K.

“Store growth is our No. 1 priority right now,” Riccobono said. “We’ve been opening 25 a year, which is rare in fashion. People don’t think about Canada much as a fashion market, but it’s really big for us, and it’s not easy to succeed there. I’m most excited about our new London stores. International store growth is a main focus.”

Simplicity may be the message the brand is selling to the consumer, but making a shorter shirt with a specific length is actually quite difficult. Riccobono said traditional shirt manufacturers do not normally cut shirts to an exact, uniform length, since tucking them in makes an inch or two of variance irrelevant.

“Our shirts are significantly more expensive to make,” Riccobono said. “People come to us saying they can make our shirts for X amount of dollars, but then we show them the process of getting them the exact right length every time, and they walk away. The factory that makes our shirts does so for another well-known brand, and they can do 1,000 of their shirts in the same time it takes to make 600 of ours.”

Untuckit does not have any wholesale partners, as Riccobono said the brand still has a lot of room to grow just in the DTC world.

“Something has clicked in the last year,” Riccobono said. “Other brands are struggling, but we’re growing a lot. Celebrities wear our shirts, and I hear us being discussed when I’m just walking down the street. We’ve been profitable since day one, but things have really taken off in a major way.” –Danny Parisi

CEO; Naadam, Something Navy, Thakoon

Matt Scanlan

Matt Scanlan launched cashmere sweater company Naadam in 2013, growing it to become a poster brand of the direct-to-consumer model’s potential. Naadam now has three NYC stores, creates private-label product for a slew of retail partners and sells an expanded product assortment that includes jumpsuits and pajamas.

With Naadam stable and thriving, Scanlan chose to dive back into startup mode, headfirst.

This year, he signed on to take the lead of two fashion brands: Thakoon, by designer Thakoon Panichgul, and Something Navy by influencer Arielle Charnas, both of which are backed by Naadam investor Silas Chou. The moves read as the first steps toward building a large-scale DTC empire.

As Scanlan sees it, the newly established partnerships are ideal for getting a direct-to-consumer businesses off the ground: He has the experience and established infrastructure needed, and Panichgul and Charnas have the invaluable audience relationships.

“I have a playbook that’s been successful,” said Scanlan. “What I can offer is experience around supply chain, and direct-to-consumer marketing, and distribution strategy, and systems integration. But Naadam is my sensibility. The IP for these brands is all [Panichgul] and [Charnas]. I can’t do what they do, and I don’t want to influence their decisions.”

Though three brands are a lot to manage, Scanlan said he’s looking at others to add to his plate, with a plan to pass on the CEO role of each after about two years. The potential brand partners he’s currently eyeing have a cult-like following because, he said, that equates to engagement, which means conversion. “The more money you have to spend on customer acquisition, the less profitable you’ll be, because marketing and brand expenses will eat up more of your contribution margin.”

In September, Scanlan relaunched Thakoon, formerly a staple at luxury department stores and New York Fashion Week, as a direct-to-consumer brand with prices topping out at $225. The company opened its first store in NYC’s Soho neighborhood in October. Charnas’ brand is set to launch in 2020, with a focus on being female-founded, versus an influencer brand, said Scanlan.

“For Something Navy, we’re moving really fast right now around design, product development and team hiring,” said Scanlan. “I’m completely in startup mode, where I was five years ago. I made so many mistakes then, and now I’m back in that same position and absolutely crushing it, because I know exactly what to do; I have a ton of clarity on the industry. I never expected to be taking on this much at this rate, but there are times in your life where you strike while the iron’s hot. That’s what I’m doing now.” –JM

Head of industry for fashion, luxury and retail, Facebook

Karin Tracy

Customer acquisition costs may be rising on Facebook and Instagram — making it harder for young DTC brands to reach potential customers on those platforms — but Facebook’s Karin Tracy said it’s still worth it, based on the massive opportunity on both platforms and the payoff.

As Facebook’s U.S. head of industry for fashion, luxury and retail, its Tracy’s responsibility to help businesses like Dior, Sephora and Macy’s craft marketing strategies to reach customers on Facebook and Instagram. Recently, that’s included steering brands toward a mobile-first mindset, based on the potential of mobile commerce. For example, she’s helped brands including Bobbi Brown test AR ads in mobile news feeds. Brands that used this ad format saw boosts in both sales conversion and engagement, according to Facebook.

“We want to help brands reach people seamlessly in this ‘always shopping’ world, which is why we launched Shopping on Instagram, and continue to invest in tools like dynamic ads [launched in 2015] to help brands show the most relevant product to the right person at the right time,” Tracy said. Facebook could not comment specifically on the luxury or fashion verticals, but said e-commerce is a top vertical for the company in terms of ad revenue. –Katie Richards

Q&A

Global buying director, Net-a-Porter

Elizabeth von der Goltz

Net-a-Porter has had a banner year. After bringing in a record $2.3 billion across the Yoox Net-a-Porter group in 2018, the company introduced 200 new brands and 90 exclusive capsules between April and November. The Richemont-owned company has remained competitive against other multi-brand luxury retailers by getting in good with emerging designers through mentorship programs and by scouting out brands from international markets like Korea. In the process, it has put further distance between itself and main competitor Farfetch, beating its rival out in both sales and number of new brands added. Elizabeth von der Goltz, Net-a-Porter’s global buying director since 2017, led many of these projects, bringing her years of experience to the table. Prior to Net-a-Porter, she rose up the ranks at Bergdorf Goodman.

Net-a-Porter has had a big year; what initiatives are you most proud of?.

Our most exciting chapter was the launch of our Net Sustain edit, [a collection of sustainable products] because it was a huge step for our company. High and fine jewelry and watches are also a part of my job. The minute I started working at Net-a-Porter, I saw a huge growth opportunity in becoming the online destination for this category. Our customers trust us, and so, we trained our warehouse and our personal shopping department to be GIA certified. And this past June, we launched a private online destination for our top shoppers, our “EIPs,” or extremely important people. It allows them to discover collector jewelry pieces from brands like Piaget, Bassenge, Bayco and Nadia Morgenthaler. We can source and find our clients anything in fine jewelry or watches, and then we can either bring the EIP to the atelier or our personal shopping team will bring the item to them in the privacy of their home.

What are your main priorities and goals for the next year?

I’m looking forward to continuing our sustainability path in January. We will be adding beauty and a lot more to this category within the next year. I’m also thrilled about our new Vanguard brands, which we launch in February. The Vanguard program is a mentoring program for emerging designers, where we bring them on-site for two exclusive seasons and promote them in all areas of the business: through editorial properties, press, marketing and social, and in meetings with our global head executives. It’s an exciting part of my job to introduce new talent to our business and watch them grow and succeed. –Danny Parisi

CEO, Madewell

Libby Wadle

Under the leadership of CEO Libby Wadle, Madewell is going solo.

This week, J.Crew Group, Inc. announced it received approval from its creditors to spin off Madewell as an independent company and pursue a Madewell IPO.

In recent years, Madewell has seen consistent growth, thanks in large part to its booming denim business, while longer-standing J.Crew brand has struggled under rotating leadership and flitting merchandise direction. In the third quarter of 2019, Madewell’s sales increased 13% to $152 million, while J.Crew’s sales fell 4% to $415.8 million. J. Crew Group Inc. valued Madewell at close to $3 billion earlier this year.

“We’re extremely independent,” said Wadle in late October. “We share some back-of-house services, but we’re pretty much run as an independent brand.”

The secret to the 13-year-old company’s success, according to Wadle, has been “amazing product, amazing creative direction, a creative point of view, and an artful style and approach.”

“With that, we balance the importance of data, which we use across the entire organization,” she said. “We’re hungry for insights.”

This year, Madewell increasingly relied on real-time customer feedback, obtained through a closed crowdsourcing platform called Madewell Group Chat. Through the platform, the company asks 4,500 volunteer customers to weigh in on everything from upcoming products to marketing strategies.

Wadle has made a point to adhere Madewell to a startup mindset. She said the company launched after many years of R&D, at a time when disruption was rampant in fashion. Since, Madewell has remained nimble, ready for anything in the name of evolving the business.

“I really try not to be so prescriptive, because you just don’t know what’s around the corner,” she said. “The whole team riffs off of each other, as we think about new ideas, and how we want to grow or do something that is really inspiring. And those conversations are happening everywhere — with our store associates, in our group chat and with our community.”

In September, Madewell opened its first physical store tied to its men’s category, launched last year — the pop-up, located in Williamsburg, Brooklyn, featured an in-house tailor. Madewell’s made a habit of launching outside-the-box stores since 2018, opening a community-focused concept store called Madewell Commons in Austin and a jeans-focused Denim Edit store in Nashville in August.

“We look at these concepts as opportunities to show up differently within communities where we might already have one store,” said Wadle, noting Madewell also opened 10 traditional Madewell stores this year.

For Wadle, other proud accomplishments in 2019 include launching Fair Trade Certified denim and getting one of the brand’s factories Fair Trade Certified. In addition, Madewell introduced Hometown Collective, a collection of products by small businesses that are sold through Madewell. The business owners behind them receive grants, insights and access to Madewell’s leadership team to grow their businesses.

“I truly believe that it’s through partnerships like these that we’ll continue to grow our brand and and get the word out around Madewell,” she said. –JM

Co-founders, Universal Standard

Alex Waldman and Polina Veksler

Universal Standard made waves this year for its new, inclusive approach to sizing.

Since the inspiration for Universal Standard was to create a brand that did not discriminate based on size, or even require customers to think about size, founders Alex Waldman and Polina Veksler realized the need to make every one of their brand’s products for women of all sizes, so they started producing them in sizes 00 to 40.

“It’s not so much certain terminology that bothers me — like calling it ‘straight sizing’ — it’s where terms like that stem from,” Waldman said. “If you’re larger and you’re searching for clothing, you probably search ‘plus-size clothing’. If you’re smaller, you just search ‘clothing’. Larger sizes aren’t common, but larger people are. Seventy percent of women in the U.S. are over size 14. The idea of doing 00 to 40 was to just take size out of the conversation altogether. You don’t need to worry about it with us.”

After some delays, Waldman and Veksler’s dream of having all their products available in the full size range was finally realized in May. Also this year, the brand’s website has evolved to allow customers to see styles on models of every size. In addition, the company has expanded into new categories, like boots, with more to come. Since 2015, the company has raised $8.5 million from investors including Natalie Massanet, Gwyneth Paltrow and Toms founder Blake Mycosie.

“There are a lot of categories that don’t provide equal access to women,” Veksler said, citing footwear as an example. “As we expand into other categories, we are trying to create a new normal of what we want to see in the world. The only question you should ask when you’re shopping is, ‘Do I like this?’ and not, ‘Does it come in my size?’”

Next year, Waldman and Veksler will focus on store expansion. Universal Standard currently has five showrooms — in New York, Houston, Portland, Seattle and Chicago — where it holds one-on-one styling appointments. The plan is to expand the number of showrooms, to prioritize making them available to customers free of charge and to use them to host customer events.

Waldman and Veksler said that, despite the industry’s current focus on inclusive sizing, there’s still a long way to go.

“I think there is a will to be on the right side of this,” Waldman said. “There’s a lot of action, like a straight-size company making a separate capsule collection for plus size, or selling straight sizes in-store but plus sizes only online. There’s a lot of good will in that direction, but it’s not always being done right. There are a lot of people out there who want to look and feel good. It’s being done but slowly, sometimes too slowly.” –DP

Founder and CEO, ShopShops

Liyia Wu

ShopShops is giving U.S. brands of all sizes easy access to affluent Chinese consumers.

Liyia Wu launched ShopShops in 2016, driven by the idea of offering Chinese consumers an offline shopping experience online, through live-streaming. Since, it’s grown its audience of shoppers, 95% of which are female, with most ages 25 to 35. In 2018, it hosted more than 2,000 livestream shopping events, and Wu said that number has substantially grown this year.

Wu said ShopShops’ livestreams are not typically category- or brand-focused, but rather based on an interesting shopping destination, like New York or L.A. Currently, 30% of sales made through ShopShops are of apparel or shoes, 25% are of other accessories, 25% are of beauty products, and the rest are of random items, like chocolate or flea market finds. Sale prices have ranged from $5 to $25,000 for an Hermès bag.

The most popular livestreams feel authentic and are product discovery-focused, and either feature known products at a discount, or a brand with little or no presence in China. Handmade and one-of a kind pieces also sell well. “[ShopShops] provides an easy way for new brands to test the Chinese market without upfront cost,” Wu said, noting the company makes its money through sales commission.

Wu said most brands, excluding high-end luxury brands, have embraced the idea of teaming with ShopShops — luxury brands have been too worried about their brand image and how their products would be presented to shoppers. Even so, those brands likely have a presence on ShopShops, as the company often livestreams from multi-brand luxury retailers.

At the outset, ShopShops was accessible only through Chinese shopping website Taobao. In 2018, following a seed round of funding from Forerunner Ventures, ShopShops developed its own app. It is now available through both its app and Taobao, the latter of which aids in customer acquisition.

Currently, the hosts are “real people,” often students. Moving forward, featuring mega-influencers as hosts is a goal. Ninety percent are female, Wu said. A host management team recruits them, trains them and works to build a community around them. ShopShops also has a business development team that works to on-board brands and stores.

“We want to build ‘retailtainment,’ or the combination of retail, entertainment and commerce,” said Wu. She said every company looking to drive content to commerce, including Instagram, is a competitor.

ShopShops hasn’t yet invested in marketing — currently users find it organically, through word of mouth or through a referral program, said Wu. Around Chinese New Year next year, it will kick off its first marketing campaign to drive to its new version of its app, recently launched in beta mode. The new app was developed to offer shoppers more personalization, plus it will feature more editorial content related to shopping. An English version will be available to viewers in 2020.

In addition, next year Wu plans to ramp up efforts for international expansion.

“We didn’t build ShopShops just for China — shopping is a universal need,” said Wu. “We want to build a worldwide product to allow people who love to shop to open the door at any store, in any language. We want people in Japan to buy from us, and we want to sell from shops on Dubai.” –JM

Q&A

CEO, Moda Operandi

Ganesh Srivats

When Ganesh Srivats joined Moda Operandi as CEO last year, he Srivats sought to combine his tech experience as a vice president at Tesla with his fashion experience at Burberry.

Under his leadership, Moda Operandi has expanded its presence in China, brought in a chief technology officer with experience at Walmart Labs and opened its own tech hub in Chicago, leading to an increase in the company’s workforce. In addition, Srivats increased focus on data science and artificial intelligence, which has helped Moda Operandi streamline its already efficient trunk show model. Using machine learning, the company is now able to gather customer data points each season to inform what products and designers Moda should buy from in the future.

You’ve grown Moda’s workforce by 45% since you joined. What do you think has had the biggest impact on the company’s growth?

Opening offices in new geographical regions like mainland China, Hong Kong and Chicago has contributed to the growth of our workforce, but it’s the technology our people are building that will allow us to scale even more as a global business.

What was your hiring strategy?

I believe people do their best work when they’re challenged by colleagues with diverse perspectives and experiences. This year, I focused on building a strong team from all backgrounds and industries. It’s been especially gratifying attracting top-tier technology talent to Moda this year [like newly hired CTO Arpan Nanavati, who worked at WalmartLabs, PayPal and Adobe.]

What are your biggest priorities for the company in the next year?

Our focus is twofold: We’re building products that will strengthen our infrastructure and core business, [like an AI visual recognition tool that can recognize minute across seasons] and at the same time, we have a team solely dedicated to innovating with advanced technologies. –DP

Let’s block ads! (Why?)